About Us

About Convenient Capital

Convenient Capital is a global expert in the asset class of Trade Receivables Finance solutions. We are an originator of quality trade receivables from SME risk, Investment Grade risk and Local/Sovereign Government risk, which we offer for investment to our funding partners.

We work exclusively with our partner who have developed a Supply Chain Finance system, Abacus, which has been implemented with multiple banks and non-bank institutional lenders globally. We deliver trade receivables finance and Supply Chain Finance (Payables) to funders, corporates, and governments across six continents with a primary focus in Central Asia, CIS Countries, Europe, and North America.

What is ‘Trade Receivables’ Finance?

Trade Receivables is an ever growing and popular asset class that provides uncorrelated returns, high liquidity and no long-term commitments meaning your money is not locked in for long periods of time. Also, this asset class is not volatile or change in value over time like say real estate or other assets classes, it is highly stable.

Trade Receivables finance is therefore financing invoices and providing the Seller with better cash flow – instead of the seller waiting 30 – 120 days to get paid by the Buyer/Debtor, they get paid from us within 24 hours of issuing the invoice and the Buyer/Debtor pays us back later. It’s big business globally; helping all sizes and types of businesses from new start companies to multi-national global brands – we have a solution for any size company. For example, in United Kingdom invoice finance represents some 15% of UK GDP amounting to circa £300 Billion of invoice assets financed every year. Circa £21 Billion is outstanding to Invoice Finance companies at any one time.

What we do

- Convenient Capital brings quality trade receivables assets to investors, funders and banks that wish to buy and invest in this asset class. We know the different risks and types of trade receivables and we match these to the funder and investor requirements on a bespoke basis.

- We onboard all sellers, that issue invoices and who create the trade receivables, and carry out a thorough Due Diligence process, KYC/KYB, AML and other checks before we onboard a new seller. They must pass our strict requirements (which are available upon request). Additionally, we carry out a similar process on the Buyer/Debtor on whom the Seller has issued the invoice to pay.

- Through our vast network of physical supply chain partners and own origination team, Convenient Capital sources clients across all industries and commodities to assess trade receivables assets to support our clients and prospects through the Abacus network of funding institutions.

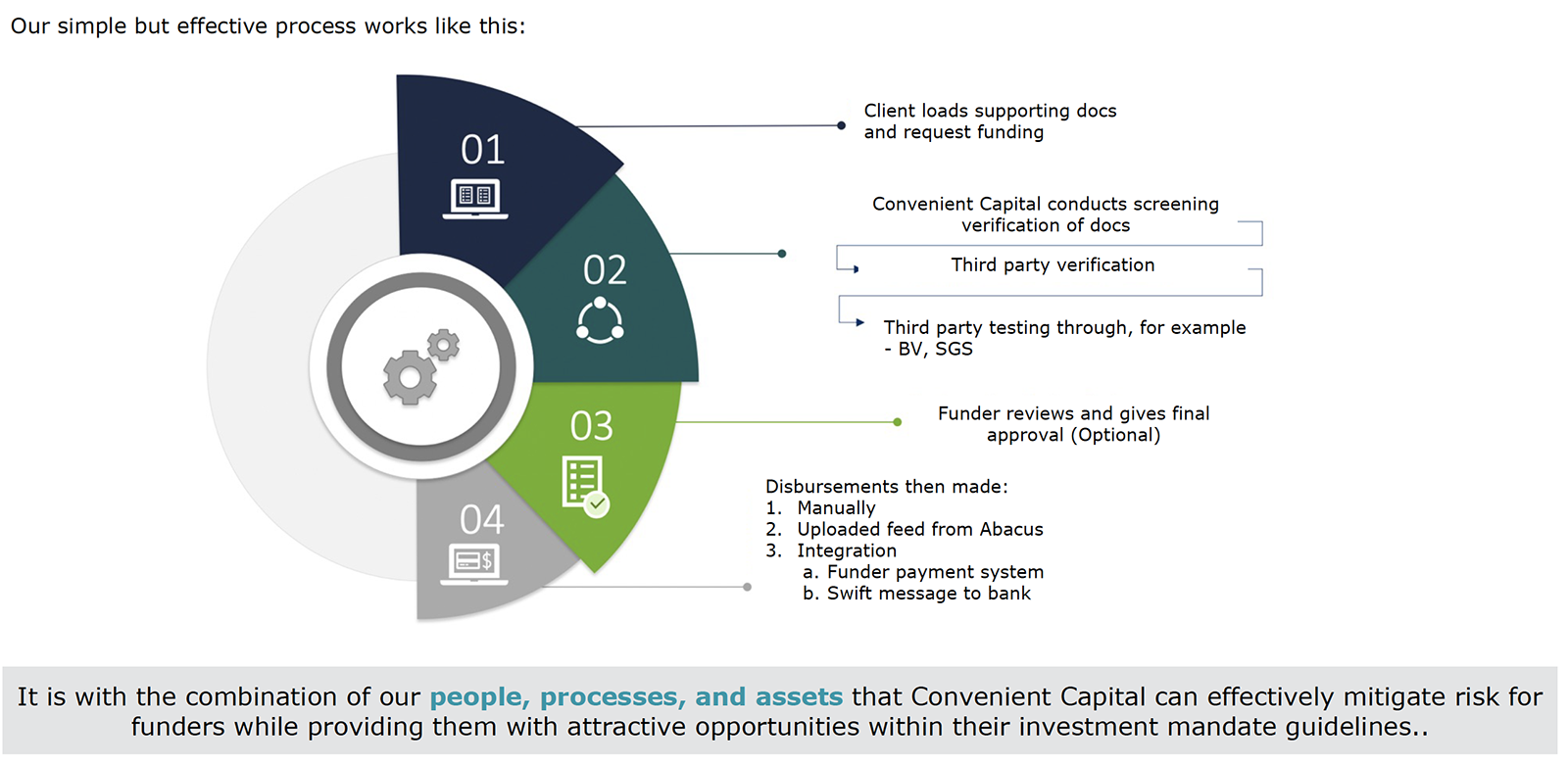

- Our Client Origination and Funder Allocation process follows a distinct approach to mitigate risk for funders while providing them with attractive opportunities within their investment mandate guidelines.